In its February 2014 issue, the International Top 100 BusinessMag recently published its list of the top 100 lawyers in America, which includes our very own Joan Lewis-Heard. The magazine notes that Joan is “highly regarded by both clients and colleagues for her experience, attention to detail and ambition…” Read the full profile from the issue here. Way to go, Joan!

Sandra Gottlieb’s article, The “Art” of Taking Minutes at Your Association’s Meeting was featured in the March 2014 issue of the ECHO Journal, published by the Educational Community for Homeowners. Sandra discusses the format of minutes, the value of brevity, conduct of the meeting, objectivity, approval and retention, among other considerations.

In the California Association of Community Manager’s Spring Edition of the Law Journal, David Swedelson’s article, Payment Plans & Voluntary Liens for Special Assessments was featured on the cover. David describes the best approach to take with regard to payment plan agreements for special assessments and describes some of the pitfalls and common mistakes that are made by associations.

HOA Law Blog

HOA Law Blog

Friday, February 14, 2014 is Valentine’s Day. A holiday that originated in Italy, it’s all about love, and it has chocolate and champagne as staple foods, making it very seductive. And dangerous, because it’s easy to get carried away. That is where your attorney can help. Several Valentine contracts have been floating around the Internet. We would like to share our adaptation of one that another attorney disseminated to his “romantically proficient” clients. It’s a non-binding contractual agreement for affection, hereinafter the “Valentine Agreement.”

Friday, February 14, 2014 is Valentine’s Day. A holiday that originated in Italy, it’s all about love, and it has chocolate and champagne as staple foods, making it very seductive. And dangerous, because it’s easy to get carried away. That is where your attorney can help. Several Valentine contracts have been floating around the Internet. We would like to share our adaptation of one that another attorney disseminated to his “romantically proficient” clients. It’s a non-binding contractual agreement for affection, hereinafter the “Valentine Agreement.”

Since the old Davis-Stirling Act was made into law in 1985, there has been a small debate over whether an owner or their association is responsible for temporary relocation costs incurred when owners in a common interest development are required to vacate their units or homes for common area repairs. Former California Civil Code Section 1364(c) stated that the “costs of temporary relocation during the repair and maintenance of the areas within the responsibility of the association shall be borne by the owner of the separate interest affected.” On its own, this provision seems clear enough; however, because this language was found in the code section that also dealt with termite fumigation, and because it followed the provision dealing with termite fumigation, some owners were confused and debated the issue with their association’s board and management, claiming that unless the relocation was as a result of a treatment for termites, their association had to pay their relocation costs. They were confused and wrong.

Since the old Davis-Stirling Act was made into law in 1985, there has been a small debate over whether an owner or their association is responsible for temporary relocation costs incurred when owners in a common interest development are required to vacate their units or homes for common area repairs. Former California Civil Code Section 1364(c) stated that the “costs of temporary relocation during the repair and maintenance of the areas within the responsibility of the association shall be borne by the owner of the separate interest affected.” On its own, this provision seems clear enough; however, because this language was found in the code section that also dealt with termite fumigation, and because it followed the provision dealing with termite fumigation, some owners were confused and debated the issue with their association’s board and management, claiming that unless the relocation was as a result of a treatment for termites, their association had to pay their relocation costs. They were confused and wrong.  From all of us at SwedelsonGottlieb, we hope you have had a joyous holiday season, and we wish you much success in the New Year!

From all of us at SwedelsonGottlieb, we hope you have had a joyous holiday season, and we wish you much success in the New Year! In the last year, prices for detached single-family dwellings have skyrocketed in Los Angeles. “A single-family house with a backyard is . . . a luxury,” mourned a 34-year-old financial analyst. No wonder “Southland Buyers Shift to Condos,” as an article in the Los Angeles Times put it.

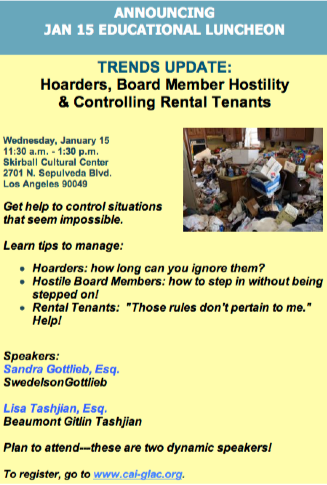

In the last year, prices for detached single-family dwellings have skyrocketed in Los Angeles. “A single-family house with a backyard is . . . a luxury,” mourned a 34-year-old financial analyst. No wonder “Southland Buyers Shift to Condos,” as an article in the Los Angeles Times put it.  Sandra Gottlieb will appear as a co-presenter on the CAI-GLAC’s luncheon program,

Sandra Gottlieb will appear as a co-presenter on the CAI-GLAC’s luncheon program,