David C. Swedelson, Esq., CCAL joins Timothy Cline, CRIMS and Tony Menke, CPCU of Cline Insurance to discuss tendering insurance claims for your association, including when you should tender losses to the carrier for various lines of coverage. This is great advice for community association managers and board members alike. It makes a world of difference if you understand your policies, how and when to file insurance claims or put a carrier on notice, and what can happen when you don’t. Catch the podcast here:

https://www.hoashow.org/episode-when-to-tender-claims-to-the-insurance-carrier/

Articles Posted in Litigation

Your California Condo or Coop Community Association Could Likely Benefit From An Umbrella Policy

By David Swedelson, Senior Partner at Swedelson & Gottlieb, California Community Association Attorneys

We are often asked how much insurance a condo or coop association should carry. I often respond by saying as much as the association can afford. Here is a great example of a situation involving one of our firms clients (the facts have been altered to maintain confidentiality). A woman was trying to get into a condo association and the parking arm was stuck. She and her entourage were physically trying to get the arm to move when it dropped hitting her in the leg. It hit an artery and she almost died. She suffered some permanent disabilities and then she sued the association.

We are often asked how much insurance a condo or coop association should carry. I often respond by saying as much as the association can afford. Here is a great example of a situation involving one of our firms clients (the facts have been altered to maintain confidentiality). A woman was trying to get into a condo association and the parking arm was stuck. She and her entourage were physically trying to get the arm to move when it dropped hitting her in the leg. It hit an artery and she almost died. She suffered some permanent disabilities and then she sued the association.

Turns out the association knew about the problem and its maintenance guy had been fiddling with the equipment to get it to work. Long story short, there was little question that the association was negligent and the association’s insurance carrier paid out almost 3 million to settle the claim just before trial was supposed to start. The association had a $2 million general liability policy. Fortunately, the association also had a $1 million umbrella policy and with that additional money was able to settle a claim that had the potential for damages that could have exceed the association’s insurance coverage. This is just one of many other examples.

So, what is an umbrella policy?

Continue reading

Condo Associations Can Regulate Nuisance Hard Surface Flooring (Even If the Owner Has Allergies); Ryland Mews v. Munoz

By David Swedelson, Partner at SwedelsonGottlieb, Community Association Attorneys

Many homeowners want hard surface flooring instead of carpet. And they will often present a prescription from their doctor for a hard wood floor in an effort to get around their association’s restrictions or prohibitions on hard surface flooring. Yes, a prescription for a hard wood floor on a doctor’s prescription form. But anyone that works with condos knows that hard surface flooring may create nuisance problems for the downstairs neighbor. And when the downstairs neighbor complains to the board about the hard surface floor that was not approved and violates the CC&Rs, the board is sometimes reluctant to take legal action thinking that a court is not going to rule in its favor. The California Court of Appeal debunked that thinking in the case of Ryland Mews v. Munoz upholding a California condominium association’s ability to limit hard surface flooring in response to nuisance complaints.

The story in the Ryland Mews case is all too familiar. Munoz moved into their upstairs unit at Ryland Mews and replaced the carpets with hardwood floors allegedly to accommodate the wife’s severe dust allergy. And it was not to soon after that when the downstairs neighbors complained about the additional noise they were now hearing.

When the association’s manager wrote to Munoz regarding the complaints and the fact that the alteration of the flooring was made without prior approval of the association, Munoz did not respond within the 30 days Management had given them. Management wrote to Munoz again, this time requesting Alternative Dispute Resolution (ADR) under the Davis-Stirling Act. Munoz still did not respond to the Association’s Request for Resolution.

Continue reading

California HOAs Are Not Liable For Damages Caused by a Minor, Trivial, or Insignificant Defect in the Common Area

By David Swedelson, Senior Partner at SwedelsonGottlieb, Community Association Attorneys

I recently assisted a large condominium association in dealing with a claim by an owner that she had fallen and injured herself after tripping on a common area walkway. Management looked at the area where this woman claimed to have fallen, and all they could find was a slightly raised area of concrete – a trivial defect. It reminded me of a 2011 Court of Appeal decision in the case of Cadam v. Somerset Gardens Townhouse HOA involving a 63-year-old woman who was injured when she fell after tripping on a separation in a concrete walkway next to the townhome she was leasing.

I recently assisted a large condominium association in dealing with a claim by an owner that she had fallen and injured herself after tripping on a common area walkway. Management looked at the area where this woman claimed to have fallen, and all they could find was a slightly raised area of concrete – a trivial defect. It reminded me of a 2011 Court of Appeal decision in the case of Cadam v. Somerset Gardens Townhouse HOA involving a 63-year-old woman who was injured when she fell after tripping on a separation in a concrete walkway next to the townhome she was leasing.

In that case, Cadam filed an action against the homeowner’s association and its management company claiming causes of action for premises liability and negligence. She alleged that the walkway had shifted and adjacent sections had separated such that they differed in height by three-fourths to seven-eighths of an inch, creating a dangerous condition.

Following a jury verdict in favor of the injured resident, the trial court granted the association’s motion for judgment notwithstanding the verdict (meaning that despite what the jury found, the judge felt that the evidence was not sufficient to justify the jury’s decision and set it aside). And the judge did this despite the fact that the association’s president had testified that a defect of one-half inch or more is “probably” dangerous. The court found that no reasonable person could find that the condition was not a trivial defect under the circumstances.

Continue reading

California HOA/Condo Owners Do Not Have The Right To Have Their Attorney Attend The Association’s Board Meetings — SB Liberty, LLC, v. Isla Verde Association, Inc.

By David Swedelson, Senior Partner at SwedelsonGottlieb, Community Association Attorneys

It is a common scenario. A homeowner (usually disgruntled or in trouble with their association) either wants their attorney to attend a board meeting with them or in their place. Often, we hear about it after the meeting where the attorney appeared on behalf of their client and intimidated the board. This situation raises three hotly contested issues: (1) Do homeowners have the right to have their attorney present at board meetings? (2) Can homeowners delegate their right to attend board meetings to nonmembers? and (3) Does it make a difference in delegating powers to attend board meetings if the owner of a unit is a natural person or an entity? We have not had a solid answer to these questions. That is, until the Court of Appeal came down with its decision in the case of SB Liberty, LLC, v. Isla Verde Association, Inc. Based on this decision, we can definitively say that the answer to all three questions is NO.

It is a common scenario. A homeowner (usually disgruntled or in trouble with their association) either wants their attorney to attend a board meeting with them or in their place. Often, we hear about it after the meeting where the attorney appeared on behalf of their client and intimidated the board. This situation raises three hotly contested issues: (1) Do homeowners have the right to have their attorney present at board meetings? (2) Can homeowners delegate their right to attend board meetings to nonmembers? and (3) Does it make a difference in delegating powers to attend board meetings if the owner of a unit is a natural person or an entity? We have not had a solid answer to these questions. That is, until the Court of Appeal came down with its decision in the case of SB Liberty, LLC, v. Isla Verde Association, Inc. Based on this decision, we can definitively say that the answer to all three questions is NO.

The Court ruled in SB Liberty (in May of 2013) that Section 1363.05 of the California Civil Code (now found in Civil Code Section 4925) specifically states that members may attend an association’s board meetings. This means that owners cannot have their attorney, or any other nonmember, attend in their place.

Warrantless Drug-Sniffing Dogs Can Enter Condominium Common Area — In North Dakota

If you live in a condo in North Dakota and are into illegal drugs, be advised that it is OK for the police to bring drug-sniffing dogs into your association’s common area without a warrant, according to the North Dakota Supreme Court (follow this link to read the full opinion).

If you live in a condo in North Dakota and are into illegal drugs, be advised that it is OK for the police to bring drug-sniffing dogs into your association’s common area without a warrant, according to the North Dakota Supreme Court (follow this link to read the full opinion).

As summarized by a newspaper article, the North Dakota Supreme Court made this the law in their posted opinion that rejected an appeal by a West Fargo man who “was arrested for possession of marijuana with intent to deliver after police brought Disco the dog into a common hallway that [he] shared with another resident in the condo. Police say they received a tip that pot was being sold out of the residence.” Although not made clear in the article, the dog alerted its handlers to the presence of drugs behind the condominium door, and the officers obtained a warrant before searching the condominium.

The trial judge denied a motion to exclude the evidence that argued that it was an unreasonable search and seizure. “The Fargo lawyer had argued that the hallway in the condo should be considered curtilage, or part of the home, and that gave Williams an expectation of privacy.” The ND Supreme Court stated in its 5-0 ruling that the common areas of a multi-family dwelling are not protected by the Constitution, and the search was legal, stating that “. . .we conclude the condominium building’s common hallway was not curtilage, and [the resident] had no expectation that the shared space would be free from any intrusion”.

Your HOA Needs To Involve Corporate Counsel In Lawsuit Handled By Insurance Defense Attorneys

By David C. Swedelson, Esq., Senior Partner at SwedelsonGottlieb, Condo Lawyers and HOA Attorneys

Consider the following, a somewhat typical scenario: your association has been sued by an owner who claims the board failed to maintain the common area that resulted in water leaking into that homeowner’s unit, causing damage. The board tenders the claim to the association’s insurance carrier. The claim is not resolved, or it may not even be a covered claim under the association’s insurance policy, and the owner files a lawsuit. The lawsuit is tendered to the association’s insurance carrier with a request that the carrier defend the lawsuit and indemnify the association from any damages. The insurance carrier accepts the tender with limited reservations of rights (insurance carriers always reserve rights to deny coverage if it later determines or discovers there is no coverage).

Consider the following, a somewhat typical scenario: your association has been sued by an owner who claims the board failed to maintain the common area that resulted in water leaking into that homeowner’s unit, causing damage. The board tenders the claim to the association’s insurance carrier. The claim is not resolved, or it may not even be a covered claim under the association’s insurance policy, and the owner files a lawsuit. The lawsuit is tendered to the association’s insurance carrier with a request that the carrier defend the lawsuit and indemnify the association from any damages. The insurance carrier accepts the tender with limited reservations of rights (insurance carriers always reserve rights to deny coverage if it later determines or discovers there is no coverage).

What I have recited above is how most lawsuits get handled. Many boards expect that once they have tendered the claim to the insurance carrier, they can more or less forget about the claim or lawsuit. That would be a big mistake. In addition, many boards expect that the insurance company’s defense attorney is going to handle the matter and they don’t need to involve their association’s corporate counsel. That can also be a costly mistake.

While the association’s insurance carrier will, in most cases, pay the homeowner claimant for damages caused to the homeowner and/or their property, the insurance carrier will not (in most cases) pay the cost of repairing the common area (the leaking roof, deck, window, stucco, etc.) that is leaking or leaked. Many boards are shocked when they attend a mediation and hear from the insurance adjustor or claims representative, the judge or the mediator, or all three, telling the board that they have to pay for replacement of the windows, fixing the flashing, replacing the leaking pipes, the list goes on. And, of course, there may be mold or even asbestos that the carrier will likely not pay to abate.

Continue reading

Purchasers of Condominiums in San Diego’s Mixed Use Hard Rock Hotel May Not Sue for Securities Violations

By David Swedelson, Senior Partner SwedelsonGottlieb, Condo Lawyer and HOA Attorney

The Court of Appeal recently came down with a decision regarding a lawsuit filed by several condominium owners who bought units in the Hard Rock Hotel San Diego, a mixed-use development with 420 condominium units. The Court of Appeal’s decision indicates that when these owners bought their units, they not only entered into purchase agreements, they also signed rental management agreements eight to fifteen months later. Does this mean that they get to sue for securities violations? Relating to a condo association? The following is a good definition of “Securities Fraud”.

The Court of Appeal recently came down with a decision regarding a lawsuit filed by several condominium owners who bought units in the Hard Rock Hotel San Diego, a mixed-use development with 420 condominium units. The Court of Appeal’s decision indicates that when these owners bought their units, they not only entered into purchase agreements, they also signed rental management agreements eight to fifteen months later. Does this mean that they get to sue for securities violations? Relating to a condo association? The following is a good definition of “Securities Fraud”.

Securities Fraud: A type of serious white-collar crime in which a person or company, such as a stockbroker, brokerage firm, corporation or investment bank, misrepresents information that investors use to make decisions. Securities Fraud can also be committed by independent individuals (such as by engaging in insider trading). The types of misrepresentation involved in this crime include providing false information, withholding key information, offering bad advice, and offering or acting on inside information.

Continue reading

The HOA was Sued and We Should Tender – What Does That Mean?

By David Swedelson, Condo Lawyer and HOA Attorney, Partner at SwedelsonGottlieb, Community Association Attorneys

It is not uncommon for a condo association or HOA to become embroiled in some sort of dispute or litigation as a defendant, having been named in a lawsuit by a disgruntled owner. The lawsuit comes in, and after being evaluated to determine if it is a case that should be defended by the Association’s insurance carrier, it is tendered to the carrier. The fact that the Association has been named in the lawsuit raises several questions:

It is not uncommon for a condo association or HOA to become embroiled in some sort of dispute or litigation as a defendant, having been named in a lawsuit by a disgruntled owner. The lawsuit comes in, and after being evaluated to determine if it is a case that should be defended by the Association’s insurance carrier, it is tendered to the carrier. The fact that the Association has been named in the lawsuit raises several questions:

• What does “tendering the lawsuit” mean?

“Tendering the lawsuit” means that the lawsuit is sent over to the association’s insurance carriers for defense. The insurance company’s obligations to provide indemnity or defense to the lawsuit is triggered by the tender. The tender is usually made by the association’s management, legal counsel or the board of directors and is usually accomplished by sending the lawsuit paperwork (the summons and complaint) to the association’s insurance broker/agent or carrier, as the case may be.

Continue reading

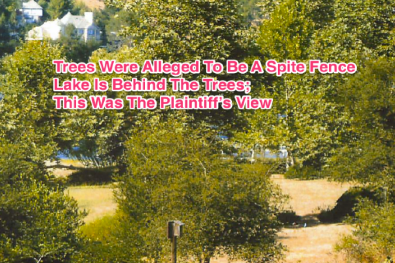

SwedelsonGottlieb Prevails In Spite Fence (View Obstruction) Lawsuit

By David Swedelson, Senior Partner at

SwedelsonGottlieb, Community Association Attorneys

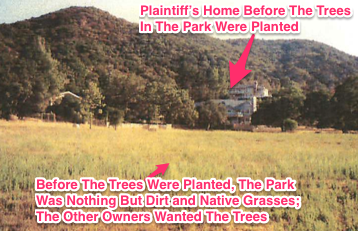

A longtime client of the firm was sued by a woman that did not live in the association who claimed that our client had illegally obstructed her view of a lake owned by our client association. After a jury trial on the sole cause of action that was left after we prevailed on a motion for summary adjudication knocking out all of her other frivolous claims, the jury decided that there was no spite fence. This result was not a surprise as the plaintiff was not entitled to her view of the lake, no matter how precious it was to her.

A longtime client of the firm was sued by a woman that did not live in the association who claimed that our client had illegally obstructed her view of a lake owned by our client association. After a jury trial on the sole cause of action that was left after we prevailed on a motion for summary adjudication knocking out all of her other frivolous claims, the jury decided that there was no spite fence. This result was not a surprise as the plaintiff was not entitled to her view of the lake, no matter how precious it was to her.

Here are the facts: the plaintiff’s home bordered a park that the association owned and maintained and she was entitled to use the park. The park was between the plaintiff’s home and the lake, hundreds of feet separating her home from the lake. The park had been, at the time the plaintiff built her home, unimproved except for two 200 year old oak trees that partially obstructed her view. Otherwise, the park was made up of dirt and native grasses. Her neighbors wanted the park improved and prevailed upon the developer of the association to improve the park as was required by the development documents and the county.  The plaintiff did enjoy a view of the association’s lake. But her view became obstructed several years later when the trees that the association’s developer planted grew up.

The plaintiff did enjoy a view of the association’s lake. But her view became obstructed several years later when the trees that the association’s developer planted grew up.

The plaintiff’s property, while not part of the association, is part of a community association, which unlike the association that is our client, is not a mandatory membership community association. It is a voluntary association, formed to manage issues of the homes in and around the plaintiff’s home (which homes were built before the association was formed). The plaintiff acknowledged that there were no restrictions on the land that require that she be provided a view or that require that our client association provide the plaintiff with an unrestricted view of the lake.

[NOTE: In the 1986 case of Pacifica Homeowners Association v. Wesley Palms Retirement Community, the California Court of Appeal concluded that “[a]s a general rule, a land owner has no natural right to air, light or an unobstructed view and the law is reluctant to imply such a right.” However, “such a right may be created by private parties through the granting of an easement or through the adoption of conditions, covenants and restrictions …”]

Continue reading

HOA Law Blog

HOA Law Blog